Jordan Daily – The Social Security Investment Fund (SSIF) CEO Dr. Ezzeddin Kanakrieh announced that SSIF’s assets have maintained their upward trajectory, reaching JD 14.5 billion at the end of Q. 3 – 2023. This marks a 5.2% growth compared to the JD 13.8 billion recorded at the end of 2022.

In a statement sent to Jordan Daily , these assets were allocated among various investment instruments; bonds portfolio accounted to 57.6 % of the total portfolio, equity portfolio 16.1%, money market instruments portfolio 13.1%, real estate portfolio 5.7%, loans portfolio 3.8%, and tourism portfolio 2.2%.

SSIF income also witnessed notable increase, surging by 21% to reach approximately JD 611 million at the end of Q.3, compared to JD 504.8 million for the same period of 2022. This growth primarily stems from the income generated by the bond portfolio, which amounted to JD 355.2 million, equity at JD 143.5 million, money market instruments at JD 88.1 million, in addition to the income of loan and real estate portfolios.

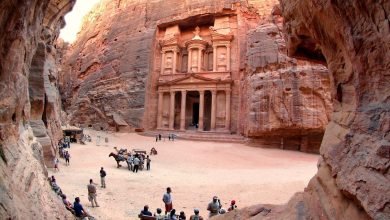

Kanakrieh said that the recovery of the tourism industry following the post-COVID-19 period, coupled with the strategic measures implemented by SSIF, have had a substantial influence on the Social Security hotels’ performance. By the end of Q.3 – 2023, these hotels have reported operational profits amounting to JD 9.6 million. These positive results primarily stem from the growth in operating revenues and high occupancy rates.

In an effort to bolster the competitiveness of its hotels, SSIF is presently in the process of designing the fourth solar power facility in Shobak in the South. This endeavor aims to ensure a sustainable source of electricity generated through solar power for Social Security hotels.

SSIF CEO announced that a lease contract has been recently signed for Karak rest house with a Jordanian investor. Following the completion of necessary maintenance work, the rest house is scheduled to be open to the public at the beginning of next year.

Furthermore, the renovation of Zay rest house has been assigned to a local contractor. The project is expected to be finalized in the first quarter of 2024, following which, local investors will have the opportunity to oversee the management of the rest house through a public tender process.

Kanakrieh said that King Hussein Bin Talal Development Area in Mafraq has successfully attracted investments totaling to JD 500 million. These investments include 58 factories, which are either currently operational or under construction. These factories cater to various industries, such as engineering and construction, chemicals and fertilizers, food processing, agricultural processing, apparel and textiles, aluminum and iron production, as well as the manufacturing of disinfectants, cleaning products, and sanitary papers.

The operating factories created 1300 jobs and the factories under construction will create 1780 jobs. Moreover, the area attracted 4 solar power projects with 175 megawatts capacity and created 630 jobs during the construction phase.

Kanakrieh further elaborated that Mafraq Development Company is presently in the process of drafting a Request for Proposal (RFP) for establishing logistics services center spanning 3,700 square meters in Mafraq. Additionally, the company has plans to extend this center in the future, with intentions to incorporate a dry port for the transportation of goods to neighboring nations, alongside the transformation of the King Hussein Air Base into a commercial airport.

Looking forward, Kanakrieh indicated that there are ongoing efforts to finishing the designs for a four-star beachfront hotel adjacent to the InterContinental Aqaba hotel. Simultaneously, designs for a new tourism destination in Aqaba are also in progress.

SSIF CEO wrapped up by highlighting that the unwavering dedication has led to a consistent track record of positive return. This underscores the commitment to strengthening SSIF’s position within the Jordanian economy and maintaining its status as the favored partner for private sector investors, whether local or international. This is part of a broader strategy to actively pursue investment opportunities and establish valuable partnerships with the goal of realizing sustained, long-term returns for the fund while also contributing to the growth of the national economy and the promotion of sustainable development.